- Rongone

- Sentient Being

Offline

Offline

- From: Keeping Calm, Sailing On

- Registered: 1/31/2015

- Posts: 2,872

Trump's tax cuts

It appears that Trump's much ballyhooed tax cut plan is about as well defined as the horizon on a foggy day. He's making a big deal about his announcement today, but we'll have to see if there is any definite reform behind the all the talk. The other problem he will face is blowback from lobbyists, corporate interests, and democrats & republicans in the legislature.

From my perspective, the argument that drastically lowering corporate income tax (very few corporations pay anywhere near the top tax rate -- in fact, many pay a lower rate than an individual taxpayer) will result in a stronger economy and lead to more hiring is pure bunk. It hasn't worked in the past, and probably won't work this time. I agree with simplifying the tax code and removing loopholes is a good thing, but I anticipate a lot of opposition to ending loophole deductions. And, what about those so-called fiscal conservatives in the legislature? What are they going to do about the increase to the federal debt they're always yelling about? Lowering the corporate tax rates without offsetting spending cuts will increase the debt.

It will be interesting to hear the unveiling of the Trump tax plan. I believe it will be a lot of theatrical trumpeting about how his administration has fulfilled another campaign promise, without a definitive plan, nor any actual activity to Implement any of the talking points.

Trump to propose large increase in deductions Americans can claim on their taxes

President Trump on Wednesday plans to call for a significant increase in the standard deduction people can claim on their tax returns, potentially putting thousands of dollars each year into the pockets of tens of millions of Americans, according to two people briefed on the plan.

The change is one of several major revisions to the federal tax code that the White House will propose when it provides an outline of the tax-overhaul pitch Trump will make to Congress and the American people as he nears his 100th day in office.

Trump will call for a sharp reduction in the corporate tax rate, from 35 percent to 15 percent. He will also propose lowering the tax rate for millions of small businesses that now file their tax returns under the individual tax code, two people familiar with the plan said.

These companies, often referred to as “pass throughs” or S corporations, would be subject to the 15 percent rate proposed for corporations. Many pass throughs are small, family-owned businesses. But they can also be large — such as parts of Trump’s own real estate empire or law firms with partners who earn more than a million dollars annually. The White House is expected to pursue safeguards to ensure that companies like law firms can’t take advantage of this new tax rate and allow their highly paid partners to pay much lower tax bills.

Trump’s proposed tax changes will not all be rolled out Wednesday. White House officials are also working to develop an expanded Child and Dependent Care Credit, which they hope would benefit low- and middle-income families facing substantial burdens in paying for child care. Trump had touted a tax measure for child care during the campaign, but it was criticized as not significantly benefiting families of modest means.

White House officials think these changes will give Americans and companies more money to spend, expand the economy and create more jobs.

The existing standard deduction Americans can claim is $6,300 for individuals and $12,600 for married couples filing jointly. The precise level of Trump’s new proposal could not be ascertained, but it was significantly higher, the two people said, who spoke on the condition of anonymity because the plan has not yet been made public.

During the campaign, Trump proposed raising the standard deduction to $15,000 for individuals and $30,000 for families.

Like other parts of Trump’s tax proposal, an increase in the standard deduction would lead to a large loss of government revenue.

A standard deduction works like this: If a couple filing jointly earns $70,000, they deduct $12,600 from their income, adjusting their income to $57,400. They then would pay taxes on the $57,400 in income, not the $70,000 they earned. Increasing the standard deduction would reduce their taxable income, ensuring that they can keep more of their money. A taxpayer who claims the standard deduction cannot also itemize deductions for items such as mortgage interest or charitable giving. But if the standard deduction is large enough, many would be likely to bypass the itemized deduction.

The nonpartisan Tax Policy Center estimated last year that if Trump raised the standard deduction as much as he proposed during the campaign, about 27 million of the 45 million tax filers who itemized their tax breaks in 2017 would instead opt to take the standardized deduction, creating a much simpler process.

This would also match one of the goals outlined by Treasury Secretary Steven Mnuchin. He has said that filing taxes has become too complicated for many Americans and that his goal would be for many Americans to be able to file their taxes on a “large postcard.”

White House officials including Vice President Pence also met late Tuesday with congressional leaders and said they wanted to pass a tax-code overhaul through a process known as “reconciliation,” a person familiar with the meeting said, which means they could achieve the changes with only Republican votes.

They also said they were going to push for steep cuts in tax rates but would be willing to raise some new revenue with other changes to the tax code. The White House on Wednesday is expected to reiterate this openness to new revenue without getting into specifics of which tax changes it would seek, as that could create a fierce corporate blowback based on which exemptions could be cut.

Congressional Republicans praised President Trump’s ambitious effort to overhaul the tax code and slash corporate income tax rates to 15 percent.

But they cautioned that some parts of the plan might go too far, illustrating the challenges the president continues to face in his own party as he seeks political support for one of his top domestic priorities.

Sen. Orrin G. Hatch (R-Utah) and Rep. Kevin Brady (R-Tex.), who head Congress’s tax-writing panels, said they were open to Trump’s plan to push forward with sharp cuts in the rates that businesses pay but suggested that changes might be needed.

“I think the bolder the better in tax reform,” said Brady, who chairs the House Ways and Means Committee. “I’m excited that the president is going for a very ambitious tax plan.”

Hatch, meanwhile, said the White House appears to be “stuck on” the idea that certain small businesses, known as S corporations, should have their tax rates lowered to 15 percent, just like large businesses. S corporations pay the same tax rates that individuals and families pay, with a top rate of close to 40 percent.

“I’m open to good ideas,” Hatch said. “The question is: Is that a good idea.”

Meanwhile, Democrats denounced the 15 percent corporate tax rate and criticized Mnuchin, who said that faster economic growth would generate enough new tax revenue to compensate for the corporate rate cuts.

Asked whether the 15 percent target was workable, Sen. Sherrod Brown (D-Ohio) told reporters: “It is, if you want to blow a hole in the federal budget and cut a whole lot of things like Meals on Wheels and Lake Erie restoration and then lie about the growth rate of the economy.”

He said that the Trump administration would have to do something “huge” such as scrapping mortgage interest deductions, adopting a border adjustment tax or relying on “outrageously inaccurate projections.”

The Trump tax package has won the support of most of the business community, but divisions remain.

The biggest winners from the corporate tax cut would include companies in industries such as retailing, construction and services that have had trouble taking advantage of the loopholes in the existing tax code.

The list of losers from tax reform could include technology companies, domestic oil and gas drillers, utilities and pharmaceutical firms that have been adept at playing the current system by using loopholes to deduct interest payments, expense their equipment and research, and transfer profits to foreign jurisdictions with lower tax rates. Under the Trump plan, many of those tax breaks would be eliminated in return for lowering the rate.

“Retail companies are the ones who pay closest to the rate of 35 percent,” said Len Burman, a fellow and tax expert at the Urban Institute. “They can’t ship their profits overseas. They can’t take advantage of the research and experimentation credit.”

A study of 2016 data for all profitable publicly listed companies by Aswath Damodaran, a finance professor at New York University’s Stern School of Business, showed that U.S. firms pay vastly different income tax rates.

On average, engineering and construction firms, food wholesalers and publishers paid about 34 percent. At the other end, oil and natural gas companies paid 7 to 8 percent on average.

“The U.S. tax code is filled with all kinds of ornaments” that help the oil and gas industry, said Damodaran. A decades-old depletion allowance, for example, allows companies to deduct money as a natural resource is produced and sold. This comes on top of other deductions for various expenses.

A Treasury Department study last year based on tax returns for 2007-2011 showed that debt-laden utilities paid only 10 percent in taxes, while construction firms and retailers paid 27 percent.“Retailers pay a higher effective tax rate of any sector in the United States,” said David French, the head of government relations at the National Retail Federation. “But the devil is in the details.”

With many key pieces of the Trump tax plan still missing, French is worried that Trump might propose something to offset the lost revenue from cutting the corporate tax rate to 15 percent. A border adjustment tax, such as the one House Speaker Paul D. Ryan (R-Wis.) favors, would more than offset the benefits of a rate cut to 15 percent, French said, “while others would see their taxes go to zero.”

French said that he expects a middle-class tax cut and business tax reform, but he does not expect Trump to unveil a complete package with offsetting items. “I don’t think that’s going to be in the president’s plan,” French said. “I expect it will be big-picture, high-level, without a lot of details.”

“There are so many special interests involved,” said Ed Yardeni, an investment strategist and president of Yardeni Research. “This is going to be a real test of whether he’s going to be able to drain the swamp or whether he’s going to pump more water in.”

Among the other big losers could be companies such as utilities or cable companies that have accumulated large debts and currently can deduct interest payments. A lower tax rate would make those tax deductions less useful.

In a report to investors in December, a team of JPMorgan analysts said that “we see reform to the corporate tax code as currently envisioned . . . as an overall net negative” for big utilities. The analysts said that because the utilities had large amounts of debt, they would be hurt more than other companies.

A big corporate tax cut could also create a crisis for individual income taxes. Without a matching cut in individual income tax rates, individuals would be able to change the structure of their pay checks so that the payments went through limited liability companies that would pay no more than 15 percent under the business tax cut, a rate far lower than the top individual rate of 39.6 percent.

That’s similar to what basketball coach Bill Self did after Kansas exempted entrepreneurs from paying taxes and eliminated the business tax. Self, the coach of the University of Kansas Jayhawks, put about 90 percent of his pay package into a corporate entity to sidestep the taxes he would have paid if it were all considered simply salary, according to a report by radio station KCUR-FM.

“Whenever a lower rate is imposed on one kind of economic activity versus another, that low-rate activity all of a sudden becomes a lot more important,” Burman said. “A lot of tax sheltering was done to make ordinary income look like capital gains.”

He added, “An associate professor in the Kansas philosophy department probably pays a higher tax rate than Bill Self.”

But if Trump cuts individual income taxes to match the cut in corporate rates, that would create an enormous shortfall in tax revenue and a ballooning of the budget deficit.

- tennyson

- Exchanger

Offline

Offline

- Registered: 2/06/2015

- Posts: 6,654

Re: Trump's tax cuts

We will have to wait and see exactly what is proposed, but it looks like this is one more not well thought out proposal that will further expose the divides within the GOP itself. While most would love a tax reduction, the effect on the deficit will be horrendous which is something the GOP railed against for years. Their backpedaling on this will leave many wondering just what the party is really about.

It should be one more interesting fustercluck for the legislative process ! ![]()

"Do not confuse motion and progress, A rocking horse keeps moving but does not make any progress"

- Goose

- Cogito ergo sum

Offline

Offline

- Registered: 1/29/2015

- Posts: 13,427

Re: Trump's tax cuts

So, corporations get a tax cut in excess of 50%.

And I get,,,,,,,,,,,,,,,,,,,,, bigger deficits, and cuts in funding for scientific research and the arts.

That about it?

We live in a time in which decent and otherwise sensible people are surrendering too easily to the hectoring of morons or extremists.

- tennyson

- Exchanger

Offline

Offline

- Registered: 2/06/2015

- Posts: 6,654

Re: Trump's tax cuts

Goose wrote:

So, corporations get a tax cut in excess of 50%.

And I get,,,,,,,,,,,,,,,,,,,,, bigger deficits, and cuts in funding for scientific research and the arts.

That about it?

And I am SURE those businesses will be passing along those cuts to the consumer ! ![]()

"Do not confuse motion and progress, A rocking horse keeps moving but does not make any progress"

- Goose

- Cogito ergo sum

Offline

Offline

- Registered: 1/29/2015

- Posts: 13,427

Re: Trump's tax cuts

tennyson wrote:

And I am SURE those businesses will be passing along those cuts to the consumer !

We live in a time in which decent and otherwise sensible people are surrendering too easily to the hectoring of morons or extremists.

- Goose

- Cogito ergo sum

Offline

Offline

- Registered: 1/29/2015

- Posts: 13,427

Re: Trump's tax cuts

Just in,,,,, the proposal WILL lower individual rates.

White House Proposes Slashing Tax Rates for Individuals and Businesses

WASHINGTON — President Trump on Wednesday proposed sharp reductions in both individual and corporate income tax rates, reducing the number of individual income tax brackets to three — 10 percent, 25 percent and 35 percent — and easing the tax burden on most Americans, including the rich.

The Trump administration would double the standard deduction, essentially eliminating taxes on the first $24,000 of a couple’s earnings. It also called for the elimination of most itemized tax deductions but would leave in place the popular deductions for mortgage interest and charitable contributions. The estate tax and the alternative minimum tax, which Mr. Trump has railed against for years, would be repealed under his plan.

As expected, the White House did not include in its plan the border adjustment tax on imports that was prized by House Republicans. However, it did express broad support for switching to a so-called territorial tax system that would exempt company earnings abroad from taxation but would encourage companies to maintain their headquarters in the United States.

The plan would include a special one-time tax to entice companies to repatriate cash that they are parking overseas.

We live in a time in which decent and otherwise sensible people are surrendering too easily to the hectoring of morons or extremists.

- Goose

- Cogito ergo sum

Offline

Offline

- Registered: 1/29/2015

- Posts: 13,427

Re: Trump's tax cuts

I see lots of cuts,, but reform?

And, we going to cut taxes, increase defense spending, not touch entitlements,,,,,,,,

I guess those cuts to public radio and meals on wheels ought to cover the decrease in revenue,,,![]()

We live in a time in which decent and otherwise sensible people are surrendering too easily to the hectoring of morons or extremists.

- Goose

- Cogito ergo sum

Offline

Offline

- Registered: 1/29/2015

- Posts: 13,427

Re: Trump's tax cuts

Democrats pan Trump's tax plan over deficit

Top Democratic lawmakers dismissed the White House tax reform package that was announced Wednesday as a plan that would increase the budget deficit, and lower tax rates most aggressively for the wealthy.

Democrats are worried that lower taxes will increase the deficit. But, a senator from Pennsylvania has it figured out.

"Pat Toomey, who serves on the Senate Budget and Finance Committees, argued that the revenue that would be generated by the economy once it's freed from higher taxes needs to be taken into account."

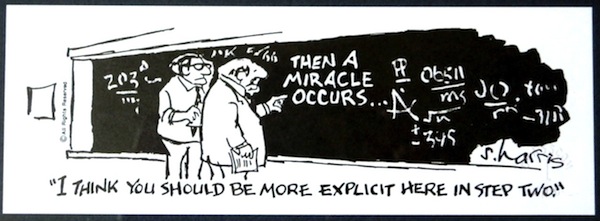

I dunno, Pat. I think that your theory could use some details.

Last edited by Goose (4/26/2017 3:12 pm)

We live in a time in which decent and otherwise sensible people are surrendering too easily to the hectoring of morons or extremists.

- Rongone

- Sentient Being

Offline

Offline

- From: Keeping Calm, Sailing On

- Registered: 1/31/2015

- Posts: 2,872

Re: Trump's tax cuts

All I heard from Mnuchin & Cohn was blah, blah, blah, this is just a general outline, we have no definitive items, hopefully the senate and house will work out the details.

In other words, we're putting this out there so Trump can claim another campaign promise has been met.

As for Toomey, obviously Pat doesn't understand that the mature economy in the U.S. over the past 60 years has grown at a 2.6% rate. Trump's claim that this will result in a 6% rate is pure wishful thinking, and the revised growth rate by Mnuchin and Cohn of Better than 3% is also a reach, especially when Trump's focus is on sectors like coal and low tech industries. To even imply that this ill defined 'plan' will provide enough growth to offset reduction in revenue is ignorant folly.

I'm all for simplification of the tax code, BUT to pass this 'news conference' and 'plan' off as a substantial detailed plan to reduce the tax burden on the majority of Americans, especially with total disregard to addressing unrestrained spending that only benefits large contributors to the two political parties, is an insult to the vast majority of taxpayers. This sideshow was merely a set up for Trump to try to cloud his ineptitude of actually submitting a reasonable legislative agenda with a bunch of talk that contains absolutely no substance.

- •

1 of 1

1 of 1